What are the benefits of hiring a professional tax agent?

Hiring a tax agent is crucial for small as well as large business owners. Tax professionals bring profitable results to the company. They also solve tax complications.

Income tax matters hold a crucial place in the business. Slight negligence can put into great trouble. So, it is a better decision to hire a good tax agent for managing all your tax matters.

Generally, small business owners handle tax matters themselves. But it is not at all a profitable idea. Filing income tax returns needs assistance from the tax agent. You can find the best accounting and bookkeeping services in your town that look after both accounting and taxation matters.

Benefits of choosing tax agent

Apart from regular filing income tax filing, tax agent can provide the following benefits to the business:

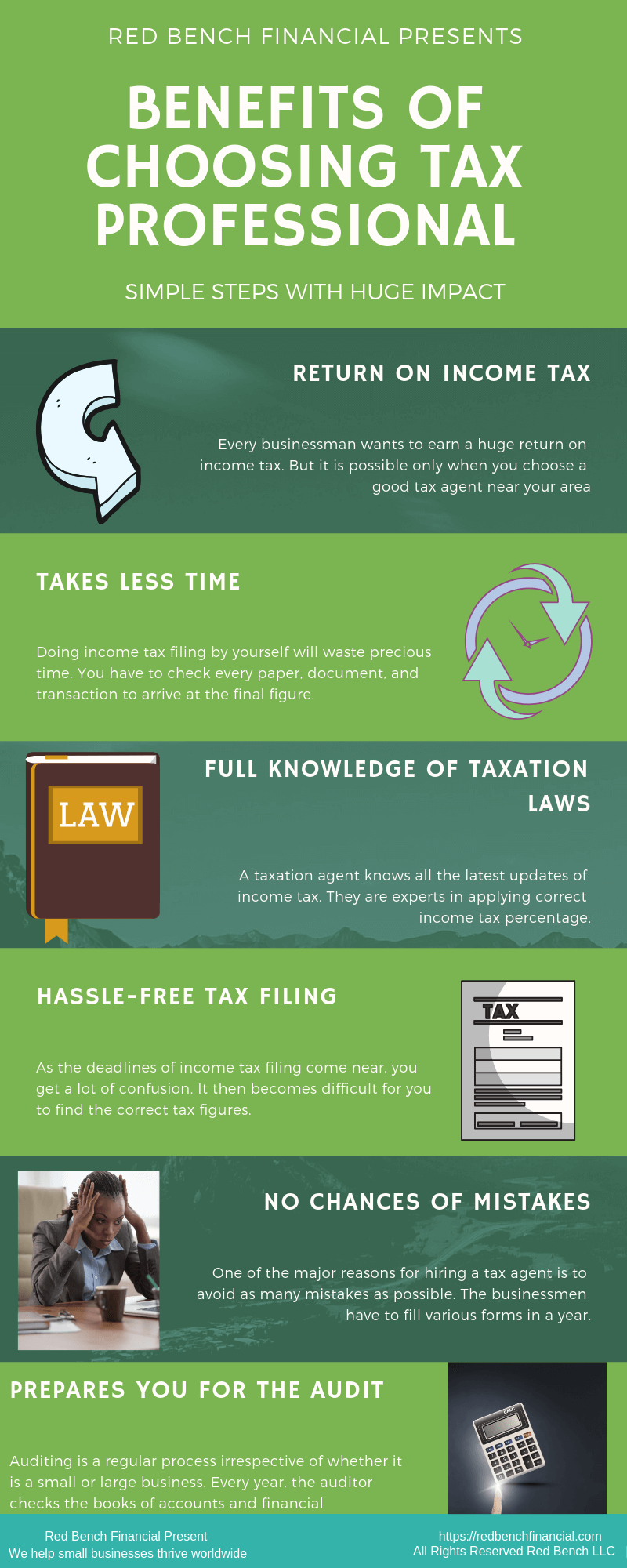

Return on income tax

Every businessman wants to earn a huge return on income tax. But it is possible only when you choose a good tax agent near your area. Tax agents are well versed with all the rules of taxation and codes. Besides that, they also know the deadlines when to file the income tax return. The tax agent will try his best to give the big returns on the income tax.

Takes less time

Doing income tax filing by yourself will waste precious time. You have to check every paper, document, and transaction to arrive at the final figure. This will take more time giving you nil results. Because of this reason, it is a wiser decision to hire a tax agent can check every tax matter. You can search for accountants near me for taxes in your area or locality on the internet. They will help not only with taxation work but also look after the books of accounts.

Full knowledge of taxation laws

A taxation agent knows all the latest updates of income tax. They are experts in applying correct income tax percentage. Furthermore, they also help you in getting the correct amount of TDS. Being a small business owner, it becomes difficult for you to know all the changing and updated laws of taxation.

A tax agent will inform you of all the updates in the field of taxation. This will save you from paying fines on late filing of income tax.

Hassle-free tax filing

As the deadlines of income tax filing come near, you get a lot of confusion. It then becomes difficult for you to find the correct tax figures. Hiring a tax agent will reduce your stress and give you returns on income tax filing. He will see every transaction and save much of your time.

No chances of mistakes

One of the major reasons for hiring a tax agent is to avoid as many mistakes as possible. The businessmen have to fill various forms in a year. So, the chances of mistakes may arise. But when you choose a tax agent, he knows exactly which form should be filled in order to get to file income tax returns.

Prepares you for the audit

Auditing is a regular process irrespective of whether it is a small or large business. Every year, the auditor checks the books of accounts and financial statements. Choosing a tax agent will also reduce your tension of auditing. You can be well prepared from before whenever there is an audit process in your company.

A tax professional will notify which documents and papers you should keep ready when there is an audit process in the company.

In addition to this, a tax agent also performs the work with perfection which is not possible if you do it yourself. These are 7 reasons why you should hire a tax agent for income tax filing.

How can we help you?

If you want a hassle-free and smooth income tax filing, choose our services. There are certain advantages of choosing us:

Experienced tax agents

Our firm hires some of the topnotch tax professionals for managing various income tax returns. They have experience of many years in the area of taxation. From tax rules to the latest updates, our team of tax professionals knows everything in depth. Their knowledge will help you in getting good returns on income tax filing.

Furthermore, our tax agents work with accuracy and file income tax returns on time. They will further save you from fines and penalties.

Accounting services

In addition to tax matters, we also provide accounting advice for small business. Our accounting team will carry out a scrutiny of all books of accounts and financial statements. It will further check the bank and credit card statements. Additionally, we also provide accounting software solutions for helping the accounts department to get smooth accounting work.

Affordable packages

Targeting mainly at the small business owners, we provide cost-effective taxation packages. Our tax agents charge less and give you high-quality services. Apart from that, their valuable tips will help in the growth of your business. Our tax agents have worked with some of the most reputed clients.

Auditing

Our team of professionals also holds experience of many years in carrying out audit procedure. We provide assistance in several types of audits such as bank audits, tax audits, and others.

Managing bank transactions

Our team of professionals also checks all the bank statements. It distinguishes between credit and cash transactions. We also make the bank procedure smoother and keep as much transparency as possible.

Conclusion

After reading this article, you know how important it is to hire a tax agent for your business. You can now enjoy returns on income tax by trusting us in the matters of income tax.

Client satisfaction is our ultimate goal and we promise to do at any cost. Apart from taxation, we also provide accounting bookkeeping services so that you can get all in one solution for your small company. From accounts payable and receivable to profit and loss statements, we have expertise in every work.

In addition to that, you can contact us through the mail or by calling us. We provide 24*7 assistance to all our clients.