Best payroll services you can pick for your business

Payroll is an important matter in any organization. Preparing salaries is a task that only a professional can do in a better way.

Every month, the employees are paid the salaries after making exemptions, additions, and subtractions. It is after making salaries that the company can count the amount of income tax one has to pay on the salary. The scenario has changed to a larger extent in companies today. Earlier, there were few people to count the salaries of the whole staff. This would increase the chances of errors. To avoid any mistake in making salaries, you can choose integrated payroll services for your small and large business. They work better than individuals and provide more perfect results too.

Many payroll services rule over the corporate world today. From managing administrative tasks to legal work, payroll services perform every activity of the company. They solve every query of employees and manage the paperwork.

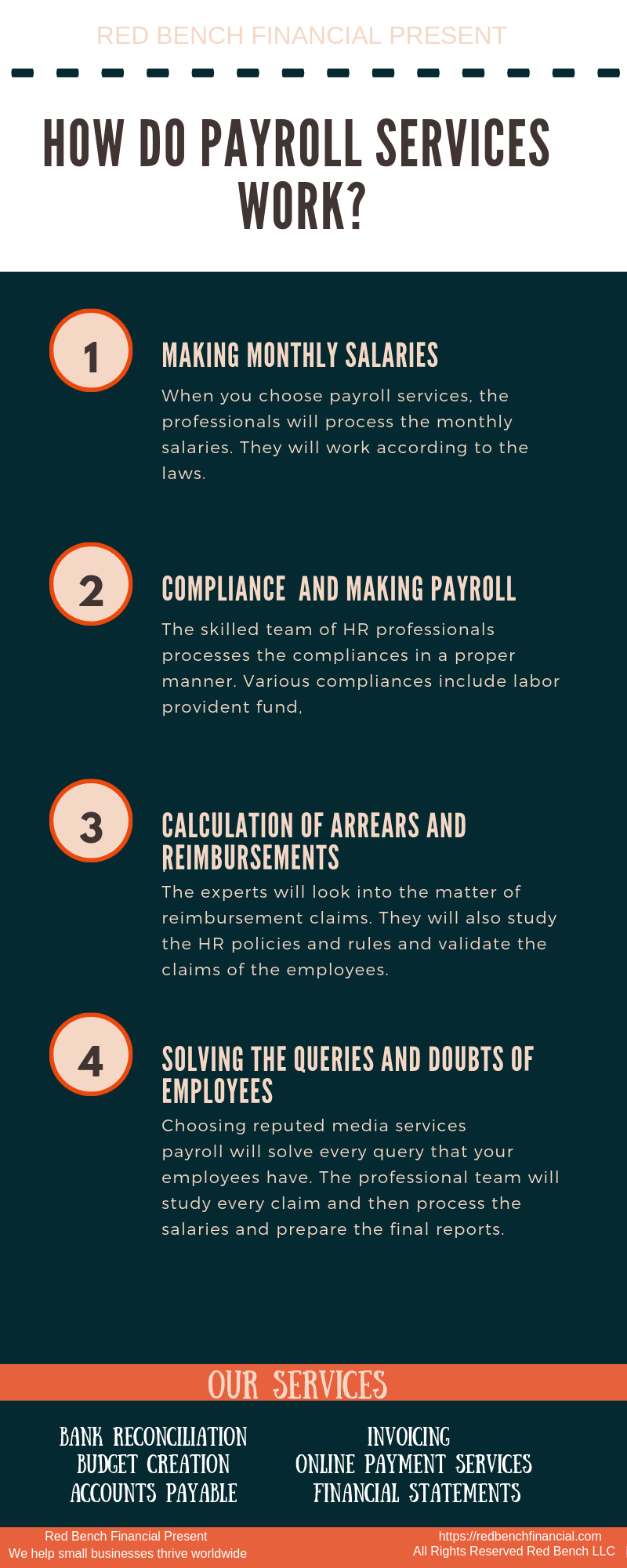

How do payroll services work?

Nowadays, both small and large companies hire payroll outsourcing services to make the salaries of the employees. Further, we will discuss how these services work.

- Making monthly salaries

When you choose payroll services, the professionals will process the monthly salaries. They will work according to the laws. Furthermore, the professionals will view the HR policies and prepare the reports. You just need to submit all the important documents and papers to the accountants. They will further carry out the work.

- Compliance and making payroll

The skilled team of HR professionals processes the compliances in a proper manner. Various compliances include labor provident fund, professional tax, and employee state insurance. They prepare monthly reports by taking into account all the information and inputs.

- Calculation of arrears and reimbursements

The experts will look into the matter of reimbursement claims. They will also study the HR policies and rules and validate the claims of the employees. After clearing the claims of the employees, the experts will prepare the monthly salaries. They will further inform the changes in the reports to the employees.

After checking all the arrear registers, the professionals will inform the employees if there are arrears in the salaries. Finally, they will prepare the consolidated report in the correct manner.

- Solving the queries and doubts of employees

Choosing reputed media services payroll will solve every query that your employees have. The professional team will study every claim and then process the salaries and prepare the final reports. They consider urgent situations and provide quick solutions too.

In addition to this, there are many other advantages to choosing high-quality payroll services. They also solve the queries of the employees in case of leave and tax matters. They further help the employees in filing quarterly and annual returns and share the same with the clients.

Good payroll services for small business in 2019

To hire good system services payroll advance, read the following list:

- Gusto

Gusto is one of the best payroll services for small business owners. It manages all the tasks of payroll in a systematic way. It is currently used by many freelancers and subcontractors in various parts of the world. It provides many helpful features such as autopilot tool, payroll reports, and others. This tool is effective in making salary sheets and payroll.

- SurePayroll

The next on the list is SurePayroll. It is a nice choice if you are a small business owner or freelancer. It does all the tasks of payroll in compliance with the employees’ policies and rules. Whether it is tax matter or reimbursement, this payroll service is efficient in doing every task related to payroll. In addition to this, SurePayRoll is very affordable in rates.

- Paycor

Although Paycor is not much popular today, it is still a good option for small business owners. It will help in making direct deposits and calculate the salaries on the basis of available information. Besides these tasks, Paycor also processes the payments. It also eases the tax matters by checking all the necessary files and documents.

- OnPay

OnPay is a simple tool to handle payroll tasks. It further helps in tax filings and prepares the detailed reports. It also takes care of various important policies and rules of employees. They direct deposits and look into the matters of reimbursements and claims. It offers various cost-effective plans.

- Wave

Wave is a superb tool offering full payroll services to the companies. This payroll service can do every task from preparing payroll to directing deposits. It will also look into claims of the employees and solve them too. You can do many activities with the help of Wave such as tracking tax liabilities and filing income tax returns.

- Highflyer HR

The next on the list is Highflyer HR. It is all in one solution for different HR tasks. You can manage all the HR functions with the help of this tool. It processes direct deposits as well as helps in income tax filing. Moreover, this tool is very simple to use by small business owners and freelancers. There is a free trial by which you can test this tool.

Conclusion

Generally, you should choose the payroll services on the basis of various factors such as budget, features, and others. While choosing the cost-effective payroll services, you should also see the quality of services they provide. Whether the services fulfill matters such as leave, reimbursements and claims are also important factors to consider.

From the above payroll outsourcing services, you can go for Gusto. It is not only a popular but also smart tool to carry out HR tasks. Furthermore, it offers reasonable plans for small business owners. It also solves the queries of the employees in matters of tax, leave, salaries and others. Gusto will give you an accurate amount to be paid to employees after considering leave and other factors.