Summary:Smart ways give smart results. We are talking about tax preparation services in Wenatchee. We simplify all the tax matters of an organization such as filing tax returns and applying tax percentage.

Small business has thousands of tasks to be done. In order to get fruitful results, the businessman must apply excellence and professionalism in the company. There are several matters in the company which need the supervision of the experts. The employees of the company take huge salaries and do not give a high quality of work. But as a small businessman, you can always put your trust in bookkeeping and accounting services. These professionals manage every task in a company in affordable fees. They apply accuracy, honesty, and expertise in the work and benefit the company in numerous ways.

Taxation is a bit complex area. Except that you take help from topnotch tax consultants, the company cannot get credit. The best way to file taxes is to hire a tax accountant. He has proper knowledge of taxation which is beneficial for your firm. Apart from that, tax accountants know all the new income tax rates and apply them while computing the salaries of the staff. They also know the latest rules and tax laws and they will update you regularly on this. This will further save your company from paying penalties and fees due to late tax filing.

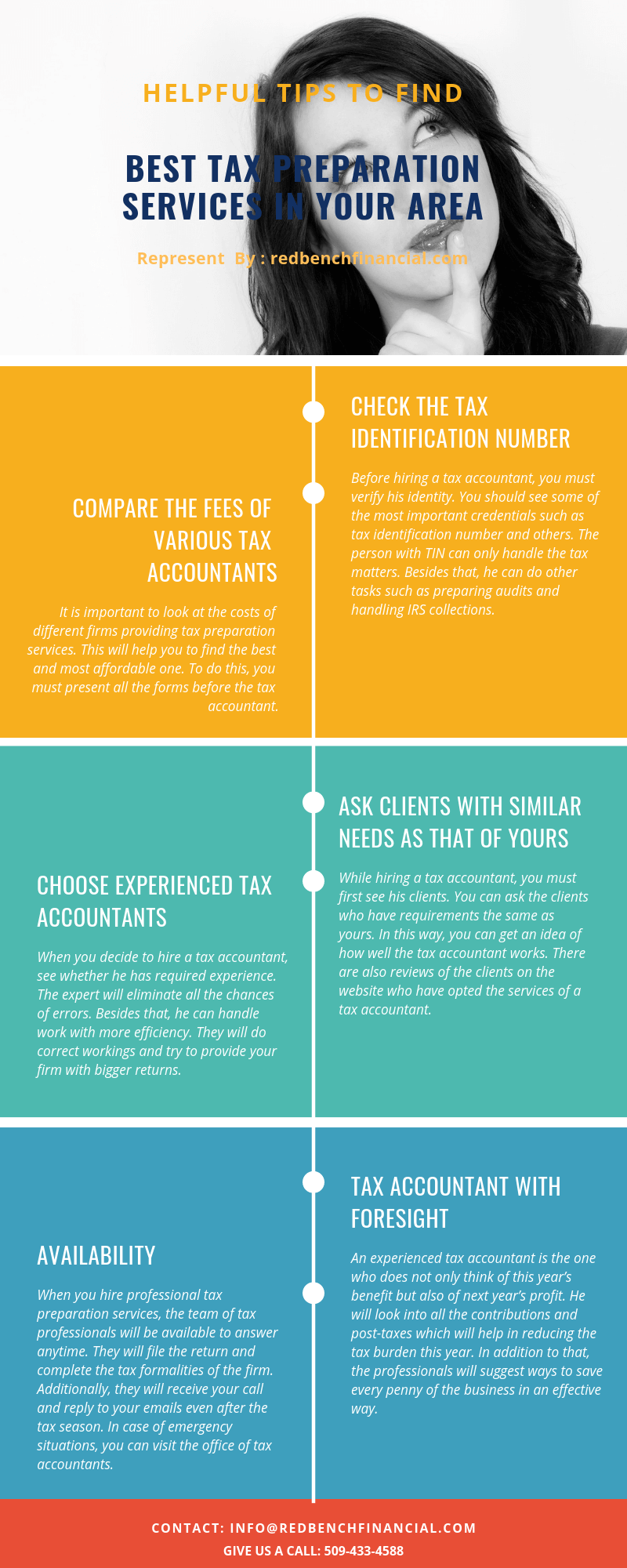

Helpful tips to find to find the best tax preparation services in your area

We discussed above how tax preparation services can benefit small companies. Now we will discuss how to find the best tax preparation services in your locality or area.

-

Check the tax identification number

Before hiring a tax accountant, you must verify his identity. You should see some of the most important credentials such as tax identification number and others. The person with TIN can only handle the tax matters. Besides that, he can do other tasks such as preparing audits and handling IRS collections. In other words, you must see whether the person managing the tax work has the proper license or not. Check whether the accountant is a member of any professional organization. You can do it by searching online all the credentials of a tax accountant.

-

Compare the fees of various tax accountants

It is important to look at the costs of different firms providing tax preparation services. This will help you to find the best and most affordable one. To do this, you must present all the forms before the tax accountant. There are many tax preparers which do not disclose their consulting fees. Some may even take their fees on the refunds you get. So, it is necessary to look at this factor and avoid such tax preparers who charge fees from the refund. Do not look at the fees of a tax accountant but only the quality of work he provides.

-

Ask clients with similar needs as that of yours

While hiring a tax accountant, you must first see his clients. You can ask the clients who have requirements the same as yours. In this way, you can get an idea of how well the tax accountant works. There are also reviews of the clients on the website who have opted the services of a tax accountant. The reviews will help you to invest in the best tax preparation services. A good tax accountant will know all the tax laws and deductions.

-

Choose experienced tax accountants

When you decide to hire a tax accountant, see whether he has required experience. The expert will eliminate all the chances of errors. Besides that, he can handle work with more efficiency. They will do correct workings and try to provide your firm with bigger returns. Additionally, he will also help the businessman during an audit. They will provide the required facts and figures to the tax authorities. Moreover, a tax accountant who has expertise will save the firms from fines.

-

Tax accountant with foresight

An experienced tax accountant is the one who does not only think of this year’s benefit but also of next year’s profit. He will look into all the contributions and post-taxes which will help in reducing the tax burden this year. In addition to that, the professionals will suggest ways to save every penny of the business in an effective way. This will lead to more savings in the company. You can, therefore, invest the savings in important areas such as training and development of the workforce, business development and purchase of new materials.

-

Availability

When you hire professional tax preparation services, the team of tax professionals will be available to answer anytime. They will file the return and complete the tax formalities of the firm. Additionally, they will receive your call and reply to your emails even after the tax season. In case of emergency situations, you can visit the office of tax accountants. They will help you anytime and solve the queries to the earliest. Moreover, the tax firms will give you proper guidance and assistance when the top authorities visit your firm.

Conclusion

You can even choose bookkeeping and business services to manage all your tax matters. These services make use of the latest tax software solutions and give you correct tax computation. Apart from tax matters, they also benefit the firm in various other ways. They will check the accounts payable and receivable. You can also get smooth banking process through bookkeeping business services.

We discussed how the best tax preparation services help the small business to flourish and grow. You have to keep in mind the above tips before you hire a tax accountant. Do not choose the new tax accountants or amateurs as they lack knowledge of tax matters. It may happen that you get wrong tax figures.

We provide reliable and best tax preparation services to small firms. You can contact us through a call, text message or email.