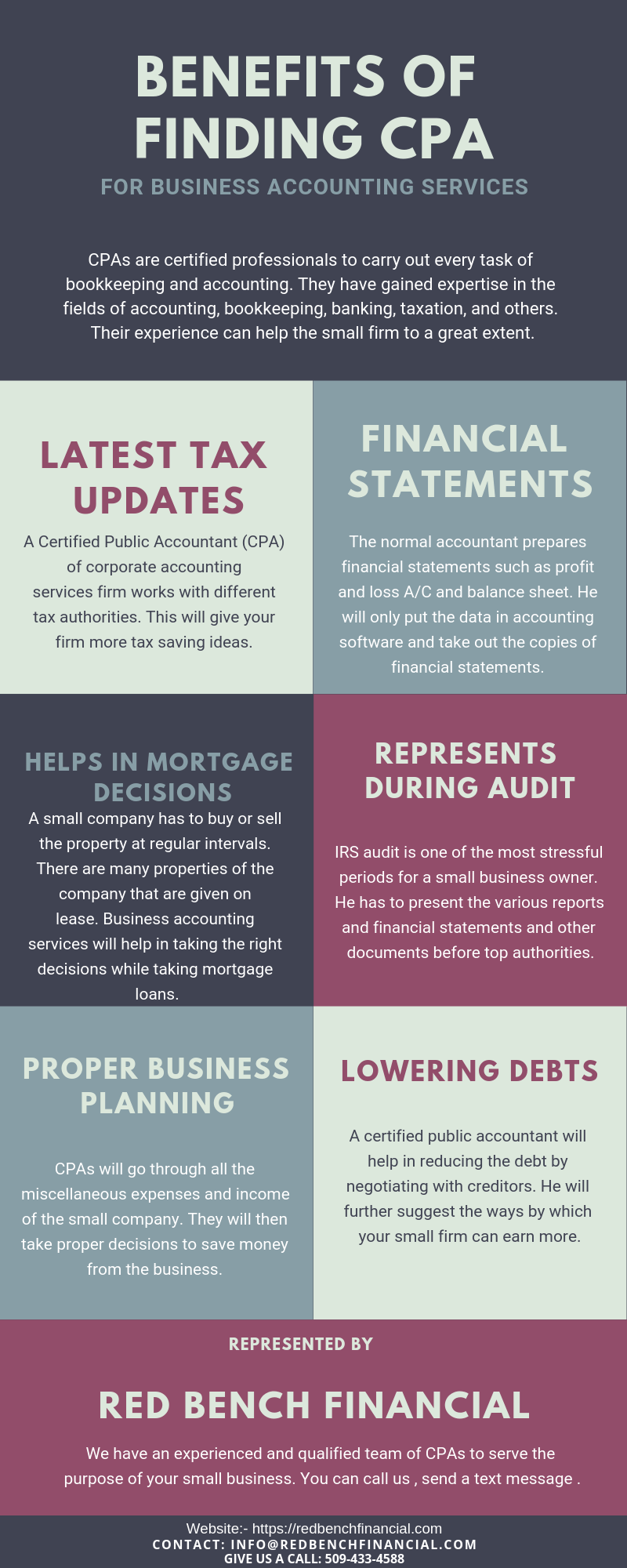

CPAs are certified professionals to carry out every task of bookkeeping and accounting. They have gained expertise in the fields of accounting, bookkeeping, banking, taxation, and others. Their experience can help the small firm to a great extent.

Benefits of finding CPA

The full form of CPA is a Certified Public Accountant. He can benefit the small firm in the following ways:

-

Latest tax updates

A Certified Public Accountant (CPA) of corporate accounting services firm works with different tax authorities. This will give your firm more tax saving ideas. Furthermore, they know the current market situations and accordingly tax rates. CPAs will suggest clients how the taxes can be decreased. Through these tips, the small firm will get many future benefits.

-

Detailed analysis of financial statements

The normal accountant prepares financial statements such as profit and loss A/C and balance sheet. He will only put the data in accounting software and take out the copies of financial statements. On the other hand, CPA will analyze these financial statements. He will also give tips to save money of the small firm.

-

Helps in mortgage decisions

A small company has to buy or sell the property at regular intervals. There are many properties of the company that are given on lease. Business accounting services will help in taking the right decisions while taking mortgage loans. A certified public accountant will suggest the best properties to be purchased. He will also give advice on other matters such as debt situations, life insurance policy acquisition, and others. A small business owner can pick the right property with the help of a CPA.

-

Represents you during the audit

IRS audit is one of the most stressful periods for a small business owner. He has to present the various reports and financial statements and other documents before top authorities. When you are thinking about how to hire a certified public accountant near me, there is no stress or burden on you to represent before the IRS. CPA will execute claims on behalf of your firm. These rights are not conferred upon the normal accountants or bookkeepers. A certified public accountant will also carry out tax audit and take other decisions related to tax matters.

-

Proper business planning

CPAs will go through all the miscellaneous expenses and income of the small company. They will then take proper decisions to save money from the business. By making the business process smoother and better, CPAs will reduce the time and funds both. As a result, the funds and time can be put in other tasks for more beneficial results.

-

Helps in lowering the debts

A certified public accountant will help in reducing the debt by negotiating with creditors. He will further suggest the ways by which your small firm can earn more.

Useful tips to get a good CPA

-

Ask people

To get a CPA tax accountant near me, you should ask your friends and relatives. Ask their feedback and reviews so that you can get an idea of how well a certified public accountant works. Furthermore, you can read the comments of the people who booked CPA services before. Additionally, you can choose the best business accounting company that has a team of skilled CPAs.

-

Qualifications

Before hiring a CPA, you must check his education and qualifications. You should also see the credentials and his total experience in accounting and taxation work. Only certified accountants can handle all the work of bookkeeping and accounting. More qualified professionals will give a higher quality of work. This will add to the profits of the small firm.

-

Total experience

It is a total experience which counts after qualification. You must see the total number of years spent by CPA in the area of accounting and taxation. Besides that, you should also make sure whether a CPA is authorized to represent you before Attorneys, IRS and enrolled agents. This will reduce your tension during audits. The professionals having more experience in handling accounting matters will bring positive results to the company.

-

Specialization in tax matters

The most important thing you must check before choosing a CPA tax accountant near me is to see whether he has any specialty. You should see his expertise and the kind of clients he handles. It is necessary to see your business needs first and then hire CPA who fulfills those needs in an effective way.

-

Structure of Fees

CPA takes fees on the basis of the hour, week, month or year. Before hiring a certified public accountant, you must see the fee structure and the total services given by CPA. It will be easier and better for you to choose the business plans by looking at the structure of fees.

-

Availability of CPA

You should hire a CPA which is available whole year. Many situations arise in the firm where you need the help of CPA. IRS audits can take place anytime in the company. During this time, a CPA will answer all the questions asked by tax authorities. He will further present all the necessary files and documents before the IRS and enrolled agents.

Conclusion

If you are planning that I should book a CPA tax accountant near me, search the different websites on the internet. You should pick the firms which match your tax prep needs like red bench financial. Apart from that, you must also look at the records of the business accounting Services Company. It is important to choose a CPA with good records for the image of your business. In addition to this, it is also crucial to hire CPA who does all taxation work himself and does not assign to another person.

We have an experienced and qualified team of CPAs to serve the purpose of your small business. You can call us, send a text message.