Tax preparation is a very crucial job in any organization. By doing correct tax workings, one can know the total income, expenses, and savings in his company. So it is necessary to hire a tax accountant for solving tax matters.

Tax preparers check every expense and income and do tax implications. They also try to give save money of the firm by bringing more deductions and credits. Furthermore, the tax accountants advise in matters of advance tax which will help the company to enjoy more benefits in the future years. Additionally, they look into the matters of wages and salaries of the employees in the company. They check whether there is any outstanding tax debt balance or not. Then, he will carry out the process to pay those outstanding amounts. They inform you if there is any tax liability on your side.

What are the common tax problems in the companies?

Some of the tax problems occur quite often in both small and large companies. If these problems are ignored, the companies may face a loss. The common tax problems are as under:

-

Wage garnishments by IRS

The employees in the company get several benefits in addition to salaries. IRS is an expert in knowing this problem. If there is any tax liability, IRS will continue to take its share until you pay the tax liability in full. After the IRS’s share, you may not get the extra benefits such as rent or car payment.

-

Levy with the bank

If you have any outstanding tax liability, it may happen that IRS contacts directly to your bank. He will take all your personal details and collect the amount due from you. In addition to that, the IRS will seize your bank account and stop all your transactions. He takes the amount from your banks after 21 days.

-

Seizure of assets

In case of any outstanding tax liability, the IRS may send you the notice of 30 days. He will first stop all your bank accounts and collect the amounts from the wages. If still there is a pending amount, he takes over your assets to get the remaining amount. He can also put the assets in the auction by giving the ads in the local newspaper.

-

Nonfiling of returns

If you have not filed income tax returns for many years, IRS will impose a criminal offense for that. The Criminal Division will then look into this matter and it will take many years to get the relief from it. In addition to that, filing false tax returns will put you into trouble.

Services provided by Tax and bookkeeping services

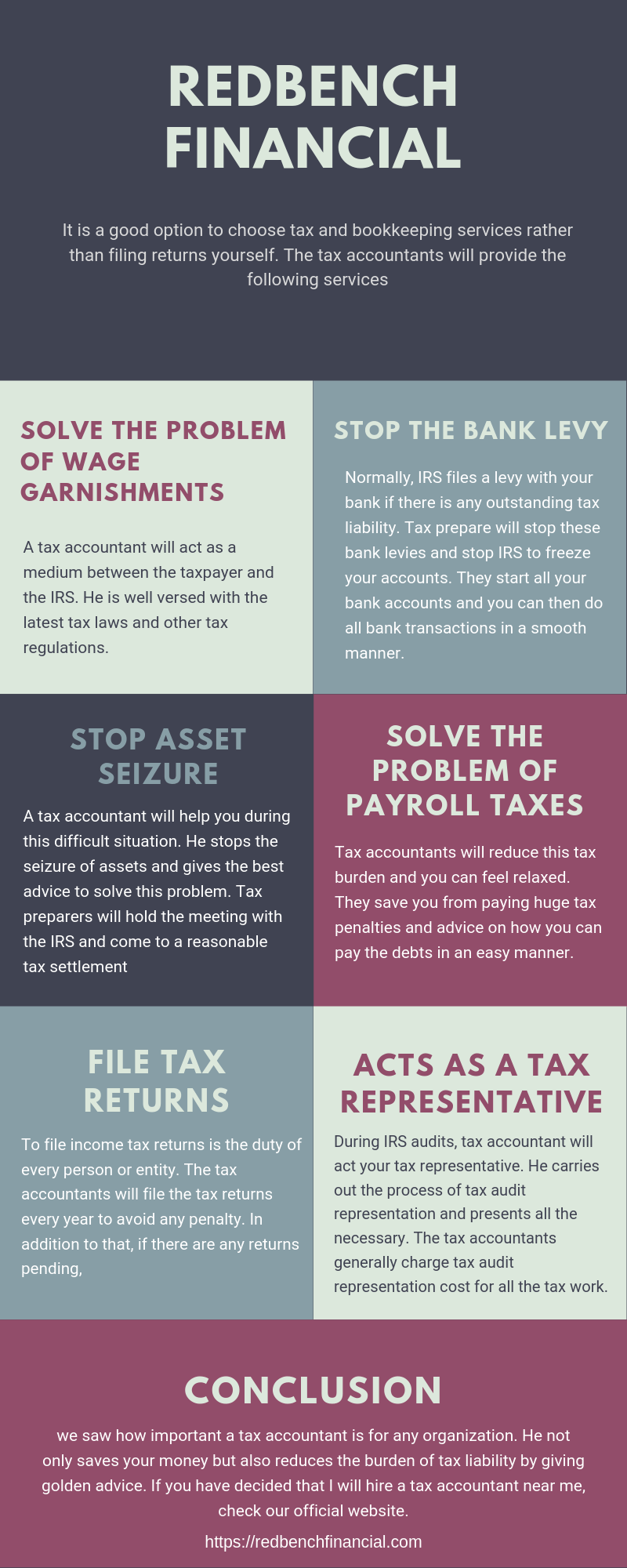

It is a good option to choose tax and bookkeeping services rather than filing returns yourself. The tax accountants will provide the following services:

-

Solve the problem of wage garnishments

A tax accountant will act as a medium between the taxpayer and the IRS. He is well versed with the latest tax laws and other tax regulations. Furthermore, tax preparers see whether IRS is bluffing the taxpayers. He stops the process of wage garnishments and provides benefits to the employees with salaries. Additionally, tax accountants know all the IRS procedures very well. He will do justice to every employee by cutting the share of the IRS from the wages and salaries.

-

Stop the bank levy

Normally, IRS files a levy with your bank if there is any outstanding tax liability. Tax preparers will stop these bank levies and stop IRS to freeze your accounts. They start all your bank accounts and you can then do all bank transactions in a smooth manner. In addition to this, you can receive and pay money through your banks once again like before.

-

Stop asset seizure

We discussed above that the IRS can seize our assets to get the tax amount. On the other hand, a tax accountant will help you during this difficult situation. He stops the seizure of assets and gives the best advice to solve this problem. Tax preparers will hold the meeting with the IRS and come to a reasonable tax settlement which will not affect your bank accounts or assets.

-

Solve the problem of payroll taxes

Many employees get the notice from the IRS to pay the outstanding tax liability. But if they go unnoticed, things may turn worse. IRS will then use the method of Enforced collection by seizing the bank accounts, assets, automobiles, and other things. Tax accountants will reduce this tax burden and you can feel relaxed. They save you from paying huge tax penalties and advice on how you can pay the debts in an easy manner. In addition to that, tax accountant will save you from criminal offenses too.

-

File tax returns

To file income tax returns is the duty of every person or entity. The tax accountants will file the tax returns every year to avoid any penalty. In addition to that, if there are any returns pending, they will provide good suggestions. They also reduce the risk of criminal investigation. Tax preparers will study and observe the whole situation and suggest the best ways to come out of tax liability within a short period of time.

-

Acts as a tax representative

During IRS audits, tax accountant will act your tax representative. He carries out the process of tax audit representation and presents all the necessary papers and documents. They hold the meetings with tax authorities and solve the matters of tax liability. The tax accountants generally charge tax audit representation cost for all the tax work.

Conclusion

So, we saw how important a tax accountant is for any organization. He not only saves your money but also reduces the burden of tax liability by giving golden advice. If you have decided that I will hire a tax accountant near me, check our official website. You can book our tax and bookkeeping services by a call or text.