Summary: Bench accounting is the latest way to manage the affairs of small, medium and large sized business. Many companies have already taken this step to get better results in the future.

The businessman has to cope with several tasks in the business. He cannot concentrate on all the tasks at the same time. Because of this reason, many businessmen hire Red bench financial bookkeeping services. These services will give ample benefits at one cost. They will maintain the book of accounts, calculate tax percentage, and check bank transactions and other tasks. Apart from that, bench accounting services will help the small firms to focus on main tasks by reducing the tension of other activities. Moreover, these services will help in making more profits by eliminating unnecessary expenses.

A good organization is the result of the efforts of various departments. Every task and activity should be done accurately to bring better results. But all these efforts go in vain if there is no proper authority to manage and view these activities. When everything is going advanced today, why not our company? We are talking about advanced business accounting services here. These services will simplify the work of top officials, HR managers and employees of the companies. In addition to that, they will monitor your income and expenses thus suggesting you good ways to save capital.

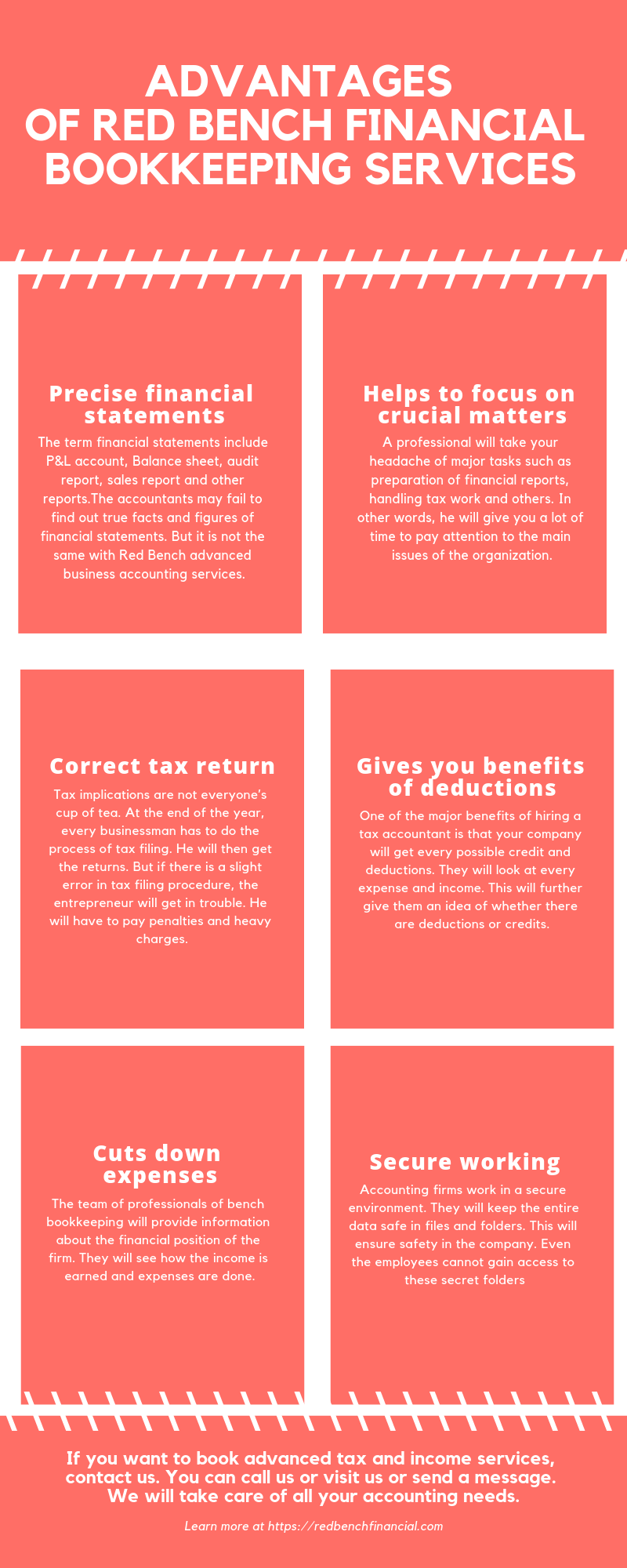

Advantages of Red bench financial bookkeeping services

-

Precise financial statements

The term financial statements include P&L account, Balance sheet, audit report, sales report and other reports. The accountants may fail to find out true facts and figures of financial statements. But it is not the same with advanced business accounting services. These firms use smart accounting software solutions to prepare financial statements. One should not question the accuracy of these accounting software solutions. They give errorless work saving time and money both. It will check every figure of sales, expense, income, and purchase. You cannot expect such accuracy from individuals or accounts manager too.

-

Helps to focus on crucial matters

A professional will take your headache of major tasks such as preparation of financial reports, handling tax work and others. In other words, he will give you a lot of time to pay attention to the main issues of the organization. You can then think about how to take forward your small business and turn into an international firm. When there is professionalism in the work, you can grow business overseas and meet new clients. Hiring advanced tax and income services is more or less a type of investment which you will only profit.

-

Correct tax return

Tax implications are not everyone’s cup of tea. At the end of the year, every businessman has to do the process of tax filing. He will then get the returns. But if there is a slight error in tax filing procedure, the entrepreneur will get in trouble. He will have to pay penalties and heavy charges. This is nothing but a waste of the company’s funds in a small matter. So, it is absolutely a good idea to hire advanced tax and income services to do this work. They have experience in handling tax matters and will file returns on due dates.

-

Gives you benefits of deductions

One of the major benefits of hiring a tax accountant is that your company will get every possible credit and deductions. They will look at every expense and income. This will further give them an idea of whether there are deductions or credits. The tax accountant will give you a list of deductions to be made in the tax workings. Deductions and credits are important and save funds of the organization. Moreover, you can put the saved funds on the development of your business. Apart from that, it will also lessen the tax liability.

-

Cuts down expenses

The team of professionals of bench bookkeeping will provide information about the financial position of the firm. They will see how the income is earned and expenses are done. The professionals show all the incomes and revenues in a clear manner. You can know exactly where the funds are spent. These professionals will suggest ways to reduce unnecessary costs which will add to the income of the business. Then you can take proper business decisions on the basis of the funds available in the organization.

-

Secure working

Accounting firms work in a secure environment. They will keep the entire data safe in files and folders. This will ensure safety in the company. Even the employees cannot gain access to these secret folders. It will reduce the risk of frauds and malpractices. Apart from that, these accounting firms choose only honest and genuine accountants. They are well versed in keeping privacy and not to leak the facts or figures to outside parties. A safe and secure environment will obviously improve the quality of work in every department.

When you hire advanced business accounting services, you should be tension free about the training and development of the staff. The professionals will manage the training of the workforce. They will bring ethics in the company for error-free working and process.

Conclusion

A small company should go for bookkeeping services to get a smooth working of the firm. These services also do other tasks such as monitoring the activities of a staff of the company, payroll, facilitating bank dealings and others. They provide different business plans for small, medium and large businesses.

Further, these services will provide such software solutions which you can use with other tools of the company. Additionally, they update you on new labor laws and other rules and regulations. These firms also look in the matters of employees’ benefits, provident fund, and other employee’s schemes. They will try to provide as many benefits to employees of the company as possible.

If you want to book advanced tax and income services, contact us. You can call us or leave a mail or send a message. We will take care of all your accounting needs.