Role of payroll services in the development of small businesses

The organization works on the efforts of its employees. To fulfill the needs of employees is the responsibility of every company. It should pay timely salaries to all the employees and provide a bonus and other benefits too. Nowadays, the companies go for express payroll services for better quality of results.

Payroll services will not only save time but also give an accurate amount of salaries. Besides that, these services have various features that will serve each of your purposes well. It is actually a smart investment you can do for the growth of your business.

How do payroll services work?

From preparing salaries to reports, payroll services are beneficial for business. We will further discuss how payroll services work.

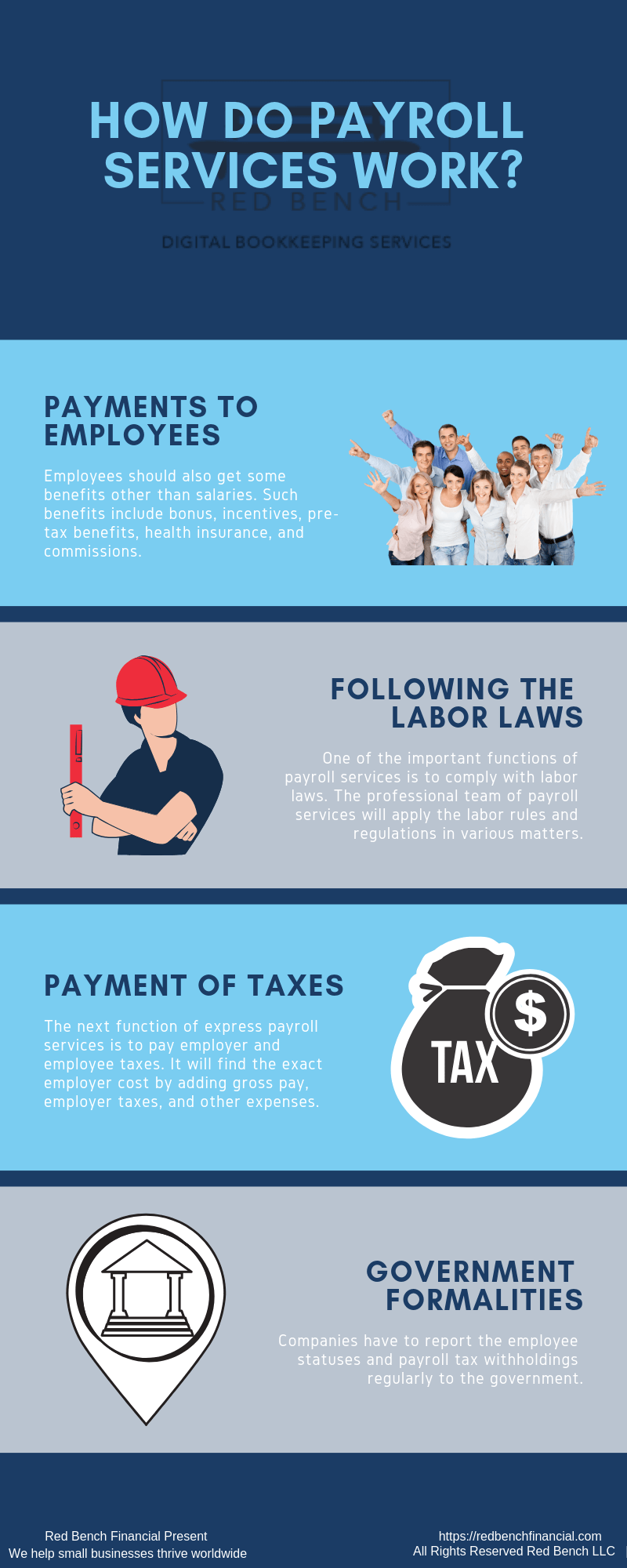

- Payments to employees

Employees should also get some benefits other than salaries. Such benefits include bonus, incentives, pre-tax benefits, health insurance, and commissions. These benefits will motivate the employees to put extra efforts to make the organization successful. Besides that, special incentives will create a good working environment in the company.

Additionally, express payroll services will reduce the paperwork through direct deposits. Payroll services prepare the schedule to pay salaries to the employees.

- Following the labor laws

One of the important functions of payroll services is to comply with labor laws. The professional team of payroll services will apply the labor rules and regulations in various matters. They include overtime, minimum wages, termination of employees and others.

Apart from that, the professionals will also notify the company whenever there is a new labor law. Following the labor laws will add to the reputation of the concern.

- Payment of taxes

The next function of express payroll services is to pay employer and employee taxes. It will find the exact employer cost by adding gross pay, employer taxes, and other expenses. This will further help the company to make wise decisions in choosing the employees.

Furthermore, the payroll services will pay the taxes after viewing their tax profiles. This will also help you in taking smart budgeting decisions.

- Government formalities

Companies have to report the employee statuses and payroll tax withholdings regularly to the government. But when you choose payroll services, the team of professionals will fulfill all the reporting requirements. They will give you relief from handling complex government formalities and regulations.

Why select online payroll services?

The primary function of payroll services providers is to prepare the salaries of the employees. In addition to that, they also perform other tasks. There are several benefits to choosing payroll services.

- Reduces fraud

Small businesses have to follow various payroll and tax rules. They are very complex in nature. But, it is no more a headache when you have payroll services online small business. The team of payroll services will look after every legislation and government rules. They will further stop the fraudulent activities by maintaining utmost privacy.

Besides that, the payroll services will reduce the risks of fraud by keeping the data confidential.

- Brings down the costs

If you are a small business owner, it is but obvious to reduce the costs. Rather than paying a big salary to payroll clerk, it is a good idea to hire payroll services. This will reduce the costs of training, equipment, office supplies, and payroll software.

Hiring team of payroll services will give benefits of best payroll software, IT support and others. You cannot otherwise manage these heavy costs in a small business.

- Helps to focus on important issues

Express payroll services will save much of the time by preparing payroll and reporting to the government. It will not only solve the tricky payroll issues but also helps you to focus on core issues. You can then solve the minor problems of the concern which will add to its success.

Besides that, the payroll services providers will prepare the financial statements and do accounting work too.

- Accuracy in the work

Payroll work has to be accurate and correct in every sense. Incorrect payroll numbers and figures will lead to tax penalties. But now, you do not have to worry as you can leave this work on payroll services. They will prepare the correct payroll by applying the latest tax rates.

They further see to it that every employee gets the right amount of salary along with other incentives.

- Good working atmosphere

When there is a good work environment, you can expect the growth of the business. Payroll services will help in bringing ethics at the workplace. The team of payroll service providers will check the activities of the upper level, middle level, and lower level management. They will inform the company if there is any fraud or false activity going in within the concern.

Furthermore, the professionals will charge the fines to the employers who act in a wrong manner. They will also check the attendance register and count the leaves of employees.

How to find good payroll services?

Now that you know what are payroll services, you can find them on the internet, However, you should see first some factors while selecting payroll services. They include the cost of hiring payroll services, features, monthly plans, advanced features, software, and others.

In addition to that, you should also check the results after using payroll services. If they give you the best results at lower costs, you can go for them. Many payroll services online small business gives you the benefit of payroll as well as accounting and finance. These services will do the data entry tasks and other accounting tasks too.

The next important factor in choosing payroll services is the ease to use. Many small business owners are inefficient to handle payroll tasks through payroll services. One must go for the payroll services that are very simple to understand by the company as well as employees. This will save time, money and efforts and bring fruitful results as well.