Tax preparation services are a good way to save the funds of the company by reducing tax liability. They are used by individuals, small, medium and large business owners.

Introduction

A few decades back, both private and public companies used to hire a single accountant to look after the matter of taxation. It is an accountant who used to prepare invoices, bills, financial statements, and tax reports too. Due to one person handling every task, there were more chances of errors. Any mistake is the area of accounting and taxation work will put the company into a big problem. The company had to pay fines and penalties for late tax filing. Because of this inconvenience, small and large business owners prefer personalized tax preparation services. These services simplify every work of taxation effectively.

Role of bookkeeping services in the business

There are many tasks that personal bookkeeping services do. They are as under:

1. Financial advice

Finance is an important concern in every company. It is necessary to spend funds wisely in order to save them for the future of the company. A personal accountant will help you in doing that. He will suggest the methods by which you can reduce the costs in the business. Furthermore, a personal accountant shows ways which will bring more income to the business. He will focus on all the areas such as sales, purchase, HR, and marketing. In addition to that, the skilled accountants try to cut the costs such as training and others for the betterment of the firm.

2. Payroll services

Payroll services are used in almost every company in the present times. Due to these services, it becomes easy for the company to save funds on payroll administration. A company needs many employees to grow. This is quite a costly task and small companies cannot afford it. Payroll services can help the small business owners to spend less on employees training, salaries and other factors. Accounting software will handle all the tasks which employees do. It prepares bills and makes financial statements. You just need to pay for accounting package and it will eliminate all the unnecessary expenses. This will automatically increase the profits of your company.

3. Bookkeeping

The main job of personal accountants is to maintain the books of accounts such as profit and loss account, balance sheet and others. It is otherwise done by the employees. This increases the risk of errors and mistakes. But, the accounting services firm will do all these tasks at lesser costs. In addition to that, it will provide accurate work at the right time. Personal accountants will review all the costs and income of the company. They record all the entries systematically according to date and time. Recording all the entries will remove the chance of errors in books of accounts. Finally, you get the right cash balance at the end of the year.

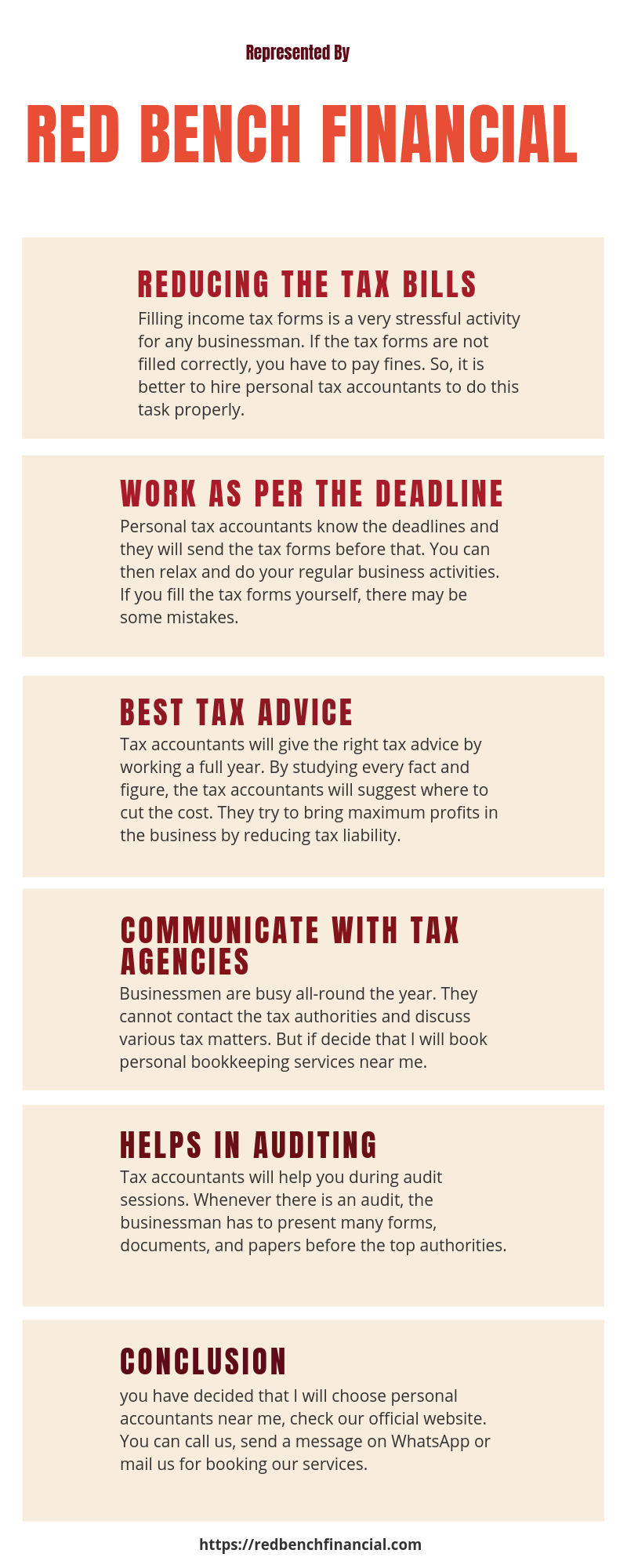

How will personal tax accountants help in tax preparation?

If you have decided that I should hire personal tax accountants near me, read the following benefits of personal tax accountants.

1. Reducing the tax bills

Filling income tax forms is a very stressful activity for any businessman. If the tax forms are not filled correctly, you have to pay fines. So, it is better to hire personal tax accountants to do this task properly. They are aware of new tax laws that will be applicable in filling the tax forms. The tax accountants know well to fill every entry in the right manner. This will reduce the tax bills and you can also save funds for developing your firm.

2. Work as per the deadline

Personal tax accountants know the deadlines and they will send the tax forms before that. You can then relax and do your regular business activities. If you fill the tax forms yourself, there may be some mistakes. The tax forms are then sent to the tax inspector and he will study every detail of the form. Each year, many tax forms are rejected due to wrong details. Tax accountants will file the income tax returns at the right time.

3. Best tax advice

Tax accountants will give the right tax advice by working a full year. By studying every fact and figure, the tax accountants will suggest where to cut the cost. They try to bring maximum profits in the business by reducing tax liability. Accountants suggest the methods following which you can get many tax advantages. Personal tax accountants will further try to bring credits to the company.

4. Communicate with tax agencies

Businessmen are busy all-round the year. They cannot contact the tax authorities and discuss various tax matters. But if decide that I will book personal bookkeeping services near me, it is the right decision you make. Personal tax accountants regular hold the meetings with tax authorities and find out the ways to bring tax advantages to the company.

5. Helps in auditing

Tax accountants will help you during audit sessions. Whenever there is an audit, the businessman has to present many forms, documents, and papers before the top authorities. He may not be aware of all the formalities to be done during the audit. But when there is a tax accountant, the small business owners can get peace of mind. The accountants will complete all the tax formalities and present the documents before the officials.

Conclusion

This is the short article on how useful a tax accountant is to your small firm. Today, there are many topnotch firms providing personalized tax preparation services in your area. You must ask these questions before hiring someone for your tax matters. Tax accountants give a helping hand in the development of the company by reducing unwanted costs. They form a strong base of the business by giving the right financial advice.

If you have decided that I will choose personal accountants near me, check our official website. You can call us, send a message on WhatsApp or mail us for booking our services.