Virtual accounting is gradually rising in every company. It is a simpler and more cost-effective way to get accurate bookkeeping and accounting work. It helps in taking quick business decisions.

Now, we will first have a glance at the meaning of virtual accounting. Virtual bookkeeping is working independently and not at the client’s office. Since it is not done from the office, the fees paid to the virtual accountants are comparatively less than office employees. Besides that, you can get the best quality work with the right facts and figures. Virtual accountants will work according to your comfort. They are available for the whole year to solve the queries and doubts in accounting and finance. Apart from accounting and financial matters, virtual bookkeeper simplifies the work of other departments such as HR, sales and taxation.

How are virtual accounting services helpful for the growth of the business?

Several small and large companies are choosing virtual accounting services over the separate accountants. The reasons are excellence in work and low prices. Let us discuss how virtual accountancy helps to grow the small business.

1. Modern accounting tools

Virtual bookkeepers are aware of all the latest tools and techniques used in the field of accounting and bookkeeping. They use the latest accounting software solutions with easy setup and processes. These software solutions prepare bills, invoices and financial statements within a few seconds. Latest bookkeeping tools will save your precious time and give faster results. Apart from that, these tools are backed with numerous features that make your work simpler and easier.

Further, these accounting solutions are safe and easy to use. Even the person without specific knowledge or talent can handle them.

2. Check accounts every week

Whenever there is any new transaction occurring in the business, a virtual bookkeeper will check it. Every bill and invoice are thoroughly checked and recorded in the books of accounts. Further, the virtual accountants check the bank statements and divide all the cash and credit transactions. They give the exact amount of cash balance that your business owns at the end of the month. The main goal of virtual bookkeepers is to make the small business owners aware of the current cash position. This will further help the businessman to carefully make use of the available funds.

3. Informs you about the financial position

A virtual bookkeeper allows you to access important data and information about your business. He will update all the figures regularly and inform you on the current financial position of the company. Regular updates will help you in taking effective decisions in the business. Furthermore, you can take decisions which will save money for the growth and development of your company. Virtual accountants will also let the employees of your company access some information. In this manner, they try to bring transparency to the company.

4. Helps you to focus on business

Virtual accounting is one of the best types of accounting services you can choose for a small business. When virtual bookkeepers work hard, why would one worry? Small business owners do not only get the benefit of affordability but also the advantage of concentrating on important matters of the business. Virtual bookkeepers take away your entire load of administration and management of the company. You can then focus on just the expansion and growth of the company.

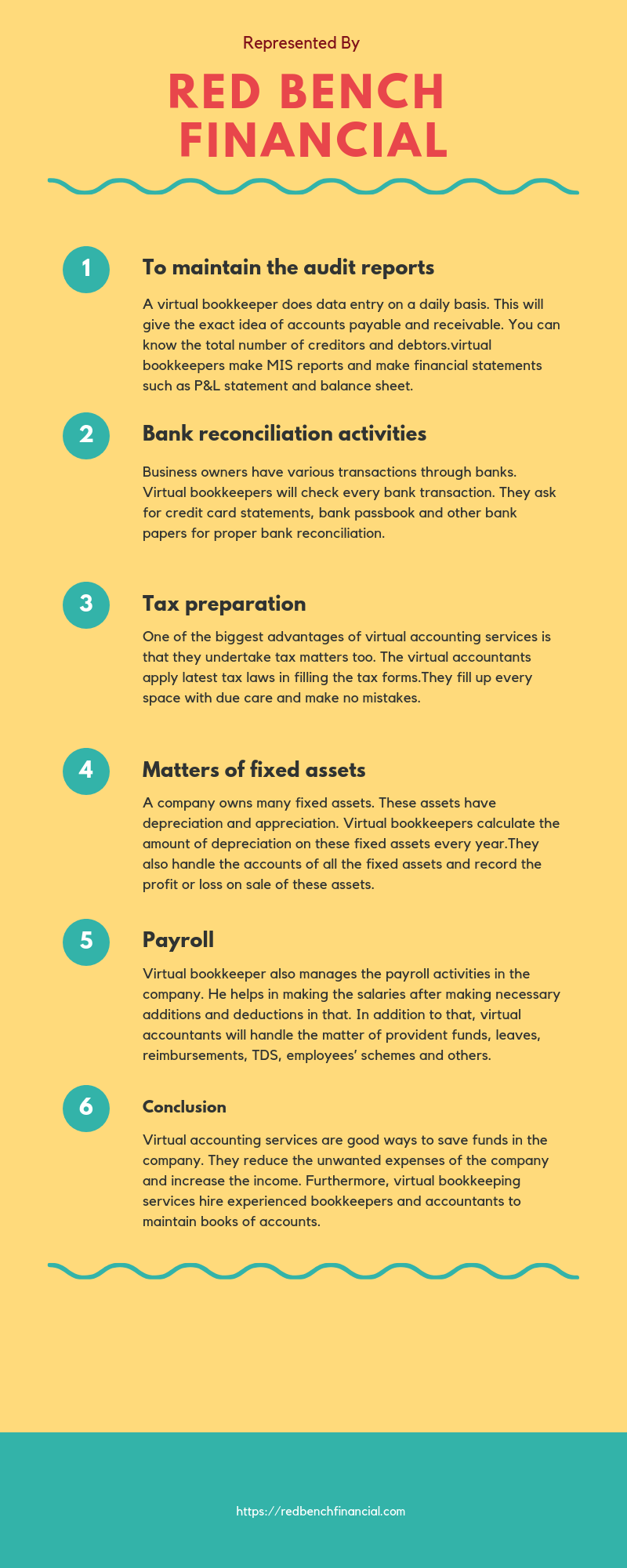

What does a virtual bookkeeper actually do in a company?

We will further discuss the tasks taken up by virtual bookkeeping services in an organization. A virtual accountant provides the following services:

1. To maintain the audit reports

A virtual bookkeeper does data entry on a daily basis. This will give the exact idea of accounts payable and receivable. You can know the total number of creditors and debtors. Furthermore, virtual bookkeepers make MIS reports and make financial statements such as P&L statement and balance sheet. Besides that, they represent your company during audits.

2. Bank reconciliation activities

Business owners have various transactions through banks. Virtual bookkeepers will check every bank transaction. They ask for credit card statements, bank passbook and other bank papers for proper bank reconciliation. By checking all the bank transactions, the virtual accountants will give the exact cash amount in the bank.

3. Tax preparation

One of the biggest advantages of virtual accounting services is that they undertake tax matters too. The virtual accountants apply latest tax laws in filling the tax forms. They fill up every space with due care and make no mistakes. Furthermore, the virtual bookkeepers meet tax authorities on a regular basis. They try to bring more credits and deductions in the business. Apart from that, virtual bookkeeper reduces tax liability by giving good tips. He tries to save the funds of the company in every possible manner.

4. Matters of fixed assets

A company owns many fixed assets. These assets have depreciation and appreciation. Virtual bookkeepers calculate the amount of depreciation on these fixed assets every year. They also handle the accounts of all the fixed assets and record the profit or loss on sale of these assets.

5. Payroll

Virtual bookkeeper also manages the payroll activities in the company. He helps in making the salaries after making necessary additions and deductions in that. In addition to that, virtual accountants will handle the matter of provident funds, leaves, reimbursements, TDS, employees’ schemes and others.

Conclusion

Virtual accounting services are good ways to save funds in the company. They reduce the unwanted expenses of the company and increase the income. Furthermore, virtual bookkeeping services hire experienced bookkeepers and accountants to maintain books of accounts. They carry out the payment procedure and pay the remaining amount to suppliers and creditors. Virtual accountants take monthly fees and suggest you the cost-effective business plans and solutions for small business owners.

If you want to book a virtual bookkeeper in your area, you can visit our official website. You can contact us by a call, text message or through an email.